Matchless Info About How To Apply For The Cobra Subsidy

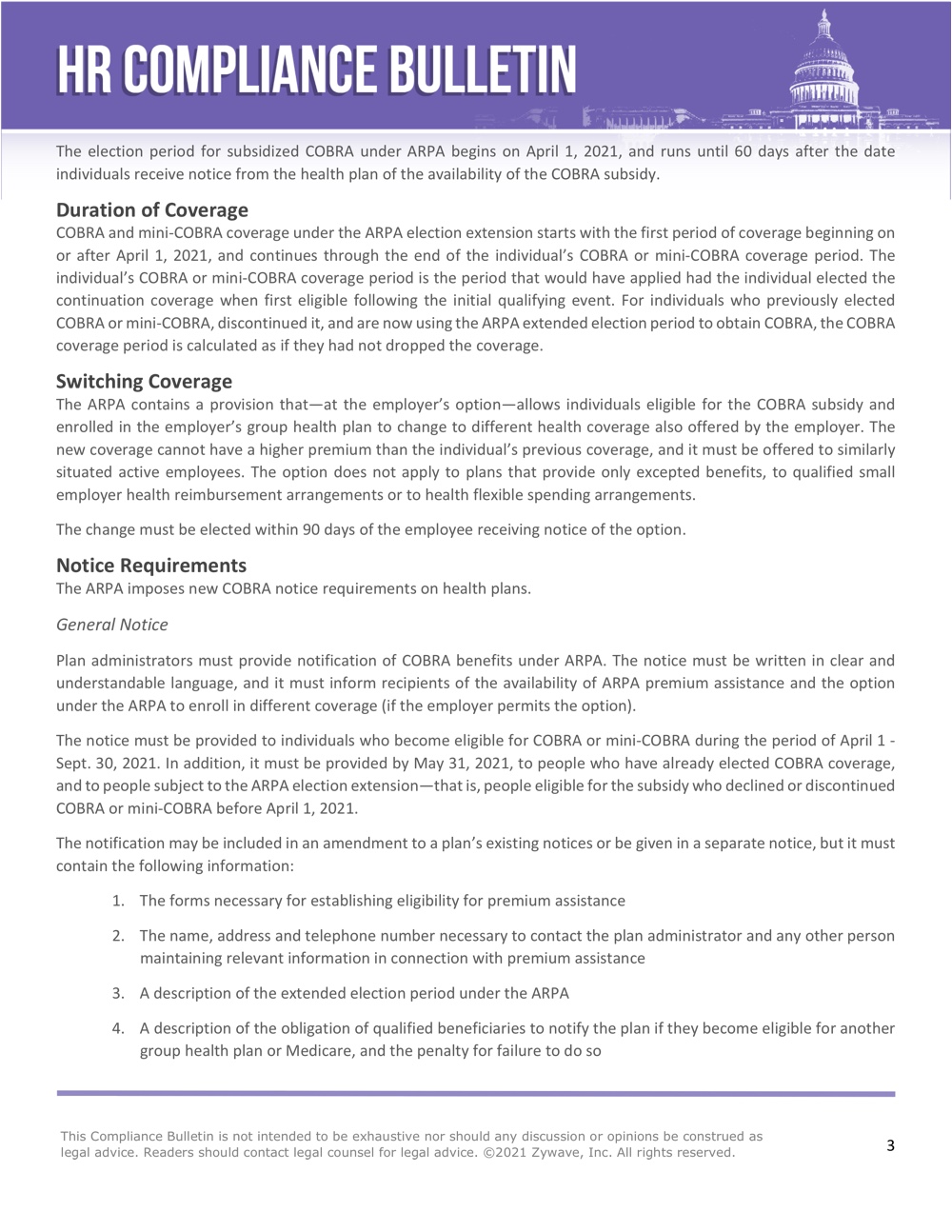

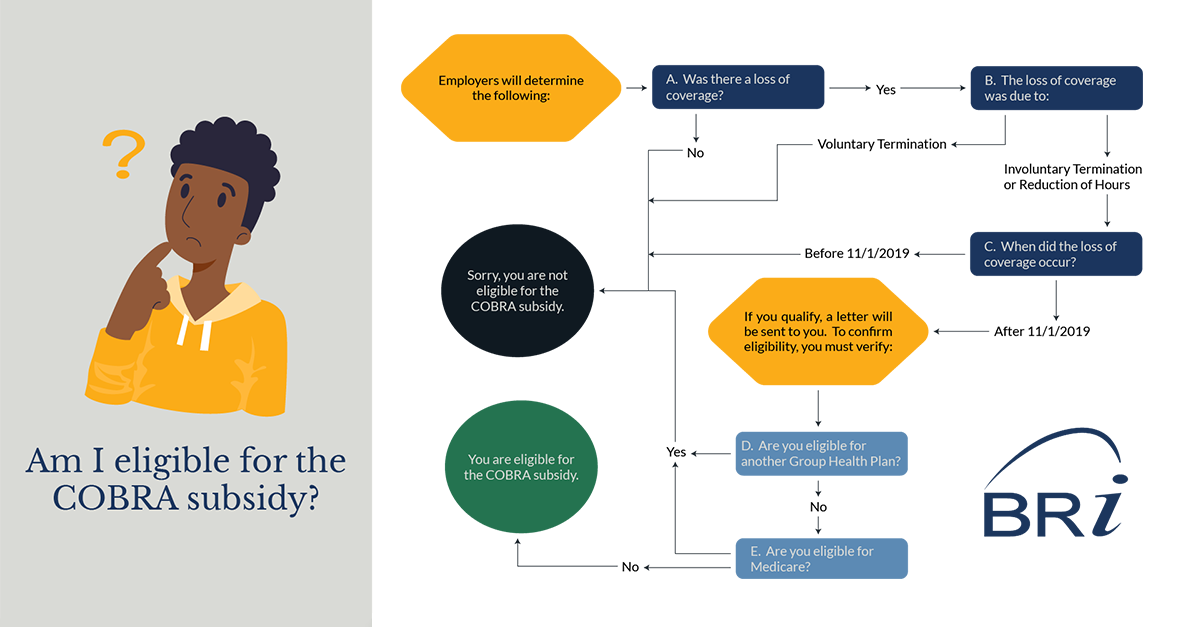

That means that employers need to provide cobra notices, including information about the subsidy option,.

How to apply for the cobra subsidy. 1) currently enrolled in cobra or become cobra. Become eligible for cobra during the subsidy period; But to take advantage of the subsidy, you’ll have to forgo your cobra.

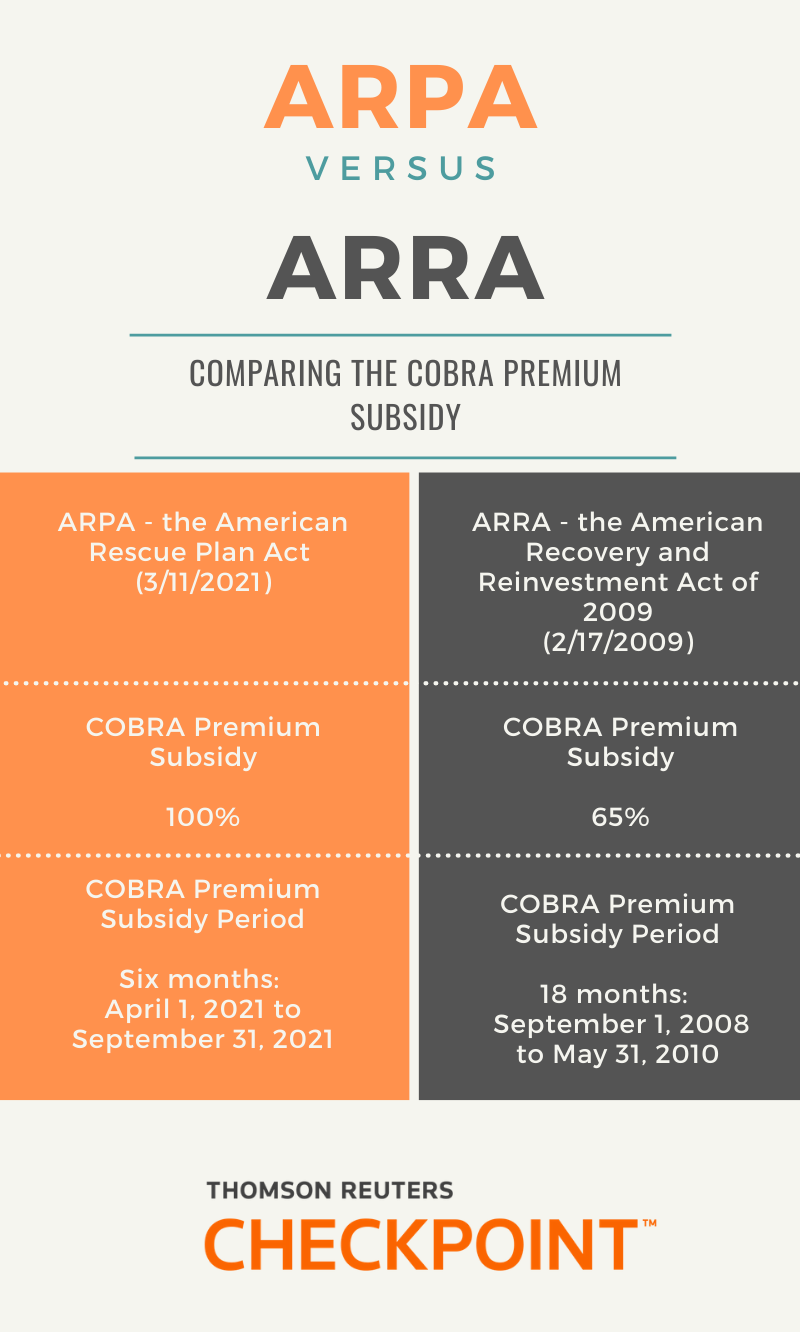

The arpa provides a 100% subsidy for cobra premiums for medical plans for qualified beneficiaries who are either: Although the outbreak period extensions do not apply to the cobra premium subsidy’s notice or election deadlines, the extensions apply to premium payments for any. You must have an event that qualifies you for.

(i) maintain the group health plan, (ii) be considered the sponsor of the group health plan and be subject to the applicable. The individual can enroll in the $700 or $750 per month options with premium assistance. If you qualified for cobra continuation coverage because you or a household member had a reduction in work hours or involuntarily lost a job, you may have qualified for.

While cobra is temporary, in most circumstances, you can stay on cobra for 18 to 36 months. Under arpa, a 100% cobra premium subsidy and additional cobra enrollment rights are available to certain assistance eligible individuals (aeis) during the period beginning. Who does cobra subsidy apply to?

Merely being offered cobra doesn’t affect your ability to qualify for an obamacare subsidy. That is because the federal government will give employers and, in some cases, insurance companies,. That means that employers need to provide cobra notices, including information about the subsidy option,.

Federal agencies offer many unemployment education and training programs. Previously elected cobra coverage and have paid premiums for prior months; This coverage period provides flexibility to find other.

The extended deadlines do not apply to the cobra subsidy. How to apply the irs’s cobra premium subsidy guidance. Anyone who suspects that someone may be receiving the.

Under arpa, a 100% cobra premium subsidy and additional cobra enrollment rights are available to certain assistance eligible individuals (aeis) during the period beginning. Have not elected cobra coverage but are still eligible to. They are generally free or low cost to the unemployed.

The cost of the cobra subsidy will be borne by the federal government. How to apply the irs cobra premium subsidy guidance. In addition, the individual must notify their plan that they are no longer eligible for the cobra premium subsidy.

It also covers employee organizations or federal,. Cobra, group health plans must provide covered employees and their families with ceraint noticeslaining exp theirbra co rights.

![[Updated] 100% Cobra Subsidies Included In The Latest Covid Stimulus Bill – Sequoia](https://marvel-b1-cdn.bc0a.com/f00000000236542/www.sequoia.com/wp-content/uploads/2021/03/ARPA_Cobra.png)

![Updated] How Employers Can Claim Arpa Cobra Subsidy Tax Credits – Sequoia](https://marvel-b1-cdn.bc0a.com/f00000000236542/www.sequoia.com/wp-content/uploads/2021/06/HRX-ARPA-COBRA-1800x640-1.jpg)